#TianqiLithium #GanfengLithium #ElectricVehicles #LithiumMarket #BatteryMaterials #ChinaMining #GlobalEnergyTransition #IndustryConsolidation

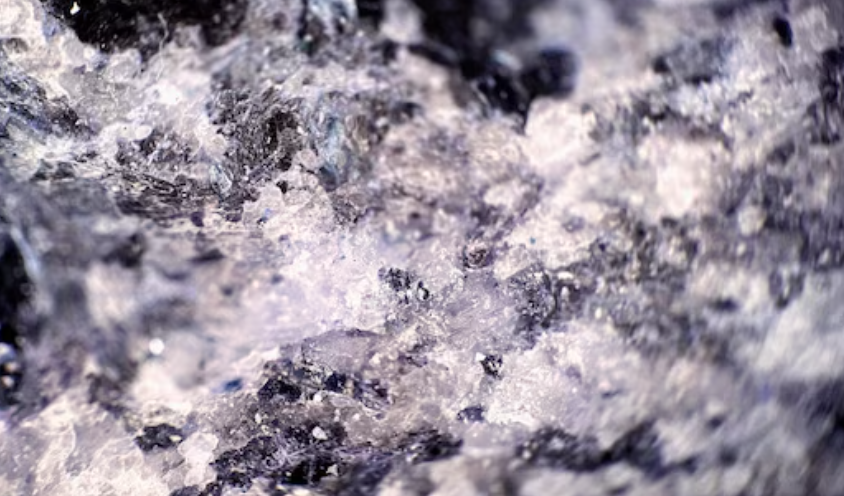

Despite facing significant financial headwinds, with net income plummeting in 2023 as lithium prices experienced a stark over 80% decline, China’s lithium mining behemoths, Tianqi Lithium Corp. and Ganfeng Lithium Group Co., have not wavered in their aggressive market expansion strategies. These companies are making bold moves to secure and expand their global lithium reserves, a critical component in electric vehicle batteries, showcasing their resilience and forward-thinking approach amidst market volatility.

Tianqi Lithium Corp. is actively seeking partnerships to unearth high-value lithium deposits, with a specific focus on accelerating its Yajiang mining and processing project situated in Sichuan province. This initiative is part of its broader strategy to strengthen its position in the worldwide lithium market, foreseeing a considerable demand surge in the coming years.

Similarly, Ganfeng Lithium Group Co. is broadening its horizon by acquiring and developing cost-efficient lithium sources, including those extracted from brine. Additionally, the company is gearing up to enhance its processing capabilities both in China and Argentina, reinforcing its commitment to scaling its operations and meeting the anticipated global demand.

These strategies are not unique to Tianqi and Ganfeng but mirror a broader trend among Chinese mining companies such as CMOC Group Ltd. and Zijin Mining Group Co., who are optimistic about the future of lithium and are thus exploring mergers and acquisitions in the battery materials realm. This optimism is fueled by emerging indicators of a potential market rebound and the critical role of lithium in powering the global energy transition.

Analysts, including those from ANZ Group Holdings Ltd., underscore the urgent need for a significant ramp-up in battery metals supply, potentially up to 3.5 times within the next five years, to meet the skyrocketing demand. This daunting challenge hints at a pending reorganization within the sector, positioning cost-effective producers at an advantage to possibly merge with or absorb higher-cost operations facing financial difficulties, as per BloombergNEF’s analysis.

This prospective industry shakeout implies that Chinese lithium mining firms are strategically positioning themselves to not only survive but thrive by capitalizing on their economies of scale, advanced exploration, and processing technologies to secure a dominant position in the post-consolidation landscape.

Comments are closed.