#GoldMarket #InvestingInsights #CopperTrends #MarketAnalysis #SafeHavenAssets #InflationHedge #GoldBullMarket #FreeportMcMoRan

Michael Ballanger of GGM Advisory Inc. takes a deep dive into the resurging gold market, offering invaluable insights that draw from his extensive experience in the investment industry. Ballanger’s journey began with a weekly newsletter aimed at offering a consolidated view of investment opportunities and market trends to his clients, evolving from a focus on venture capital to a keen interest in the precious metals sector, particularly gold and gold miners, by 2009.

His shift in focus was a response to the inflationary waves generated by the 2008 financial crisis bailouts, which inundated Wall Street with cash and credit, thus laying the groundwork for a bullish precious metals market. However, the peak of this cycle was reached in 2011, followed by a prolonged bear market exacerbated by the “Sunday Night Massacre,” a concerted effort by global banks to suppress gold and silver prices.

Ballanger’s narrative takes a pivotal turn in 2015, noting a widespread loss of interest in precious metals among the investment community, overshadowed by burgeoning sectors like cannabis and cryptocurrencies. This observation prompted a strategic rebranding of his newsletter to broaden its appeal, coinciding with the market’s bottom.

The culmination of Ballanger’s insights arrives with gold’s recent breakthrough. This resurgence to all-time highs, despite a largely indifferent mainstream media, signifies a watershed moment. Amid global uncertainties, massive liquidity injections, geopolitical tensions, and sporadic bank failures, gold’s luminance had momentarily dimmed. Yet, its sudden sprint past the crucial $2,153 barrier, as predicted in Ballanger’s early March analysis, marks a significant shift. This resurgence not only underscores gold’s enduring role as a safe haven and a hedge against inflation but also challenges the dominance of traditional financial narratives.

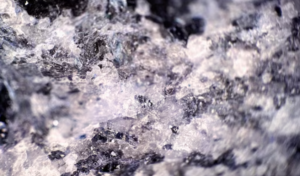

In parallel, Ballanger highlights the intriguing dynamics of the copper market, underscoring the metal’s essential role in the electrification movement and potential supply concerns. This brings to light his strong conviction in Freeport-McMoRan Inc. (FCX:NYSE), a significant player in the copper and gold production space, which Ballanger identifies as a key asset to watch, given the favorable market trajectories for these metals.

Through his narrative, peppered with historical insights and forward-looking predictions, Ballanger adeptly illustrates the cyclical nature of commodities markets and the perpetual allure of precious metals. His analysis, rich in technical and fundamental perspectives, offers a comprehensive view of current market trends, making a compelling case for the reevaluation of gold and copper among modern investment portfolios.

Comments are closed.