#EmeritaResources #MiningStocks #GoldSilver #PolymetallicExploration #IberianPyriteBelt #StrongBuy #MetalBullMarket #ResourceEstimate

Technical Analyst Clive Maund recently evaluated Emerita Resource Corp., a company he considers a potent investment opportunity, branding it a “Strong Buy” across all timeframes. Emerita Resources Corp., with its ticker symbols EMO:TSX.V, EMOTF:OTCMKTS and LLJA:FSE, focuses on polymetallic exploration, including precious metals like gold and silver. Its operations span 26,000 hectares in Spain, positioning it among the largest mineral explorers in the European Union.

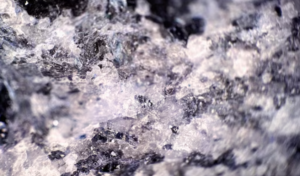

The company’s key exploration sites are nestled within the historic Iberian Pyrite Belt, stretching west of Seville towards the Portuguese border. This area, notably the Iberia Belt West (IBW) project, has recently seen the application for a mining license, signaling Emerita’s progress towards mineral exploitation. Another significant project, the Nuevo Tintilla, lies somewhat to the east, with the Aznalcollar Project also part of Emerita’s impressive portfolio, albeit currently entangled in legal proceedings. However, an out-of-court settlement seems probable before the case’s trial date, offering potential for this asset’s development.

The strategic significance of Emerita’s holdings cannot be overstated, especially in the context of the European Union’s move to secure critical minerals. The EU has deemed areas like the ones Emerita operates within as crucial for the supply of essential metals, facilitating expedited permitting processes and the possibility of additional financial support for projects like Emerita’s.

Emerita Resources has laid out a compelling case for investment, underscored by the maiden resource estimate of 2023 for the IBW Project. The juxtaposition of Emerita’s valuation with that of its neighbors in the Iberian Pyrite Belt illustrates a considerable potential for appreciation, suggesting that, even if Emerita’s assets proved only half as valuable, the upside could be substantial.

The stock’s market performance, characterized by a structurally bullish pattern despite recent dips, alongside a debt-free balance sheet and full ownership of its properties, aligns with Maund’s optimism. Historical data on Emerita’s stock portrays a company poised for a significant market revaluation, especially with the broader metals market’s anticipated bull run contributing to a positive outlook.

In conclusion, Emerita Resources appears to be at an attractive juncture for investment, especially with potential catalysts such as the settle concerning the Aznalcollar dispute on the horizon. Emerita’s strategic positioning within Europe’s critical minerals landscape, coupled with solid fundamentals and promising project valuations, make it a standout resource stock play.

Comments are closed.