#GlobalAtomic #UraniumInvestment #NigerCoup #DasaProject #UraniumMarket #SprottAssetManagement #NuclearEnergy #YellowcakeUranium

The recent political turmoil in Niger has significantly impacted the prospects of Global Atomic, a prominent player in the uranium sector. Over the weekend, Niger’s military government announced intentions to expel United States troops, stationed in the country for over a decade to combat regional Islamic insurgents. This decision has had a direct effect on Global Atomic’s stock, witnessing a near one-third decline since the announcement. As of Tuesday afternoon, the stock plummeted 29% since Friday to a price of C$2.21, bringing the company’s valuation down to C$462.7 million.

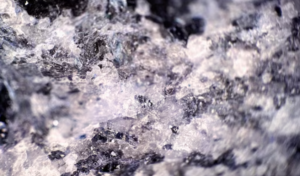

Global Atomic is at a critical juncture with its Dasa uranium project in Niger, planning to commence construction with a budget of $424.6 million after June, aiming to bring the mine into operation by the end of next year, as per an updated feasibility study. However, the July military coup complicated matters, leading to a suspension of US government funding for the project. Despite these challenges, Global Atomic successfully raised C$15 million in January by selling stock and is exploring alternative financing models to meet project requirements.

The company is exploring a mix of borrowing (60%) and equity-raising (40%) to secure the necessary funds, with President and CEO Stephen G. Roman highlighting ongoing discussions with project lenders and expressing confidence in securing the needed financing thanks to the high-grade nature of the Dasa project and the strong interest it has generated among investors.

The broader market for uranium shows resilience with a notable increase in the spot price of uranium oxide (yellowcake), despite a recent pullback from a high of $107 per lb. last month to $91 per lb. This price level remains significantly higher than last year, driven by the rising demand for clean electricity production and a looming supply deficit. Notably, China’s ambitious plans to build approximately 150 reactors over the next decade underscore the global commitment to nuclear energy as a cleaner alternative to fossil fuels.

Other uranium producers, including Canada’s Cameco and Kazakhstan’s Kazatomprom, have experienced stock fluctuations in response to the developments in Niger. Despite the political instability and operational challenges, experts like David Talbot from Red Cloud Securities emphasize Niger’s longstanding role as a reliable uranium producer and its generally favorable treatment of foreign mining operations.

As the geopolitical landscape evolves with Niger’s recent actions, including potential uranium supply negotiations with Iran, the global uranium market remains in a state of flux. However, the strategic significance of uranium for nuclear energy production and the overarching goals of transitioning to cleaner energy sources suggest a resilient market poised for growth amidst challenges. The unfolding situation in Niger represents a crucial test for Global Atomic and the broader uranium sector, highlighting the intricate interplay between political dynamics and resource economics in the pursuit of sustainable energy solutions.

Comments are closed.